Amur Capital Management Corporation Can Be Fun For Everyone

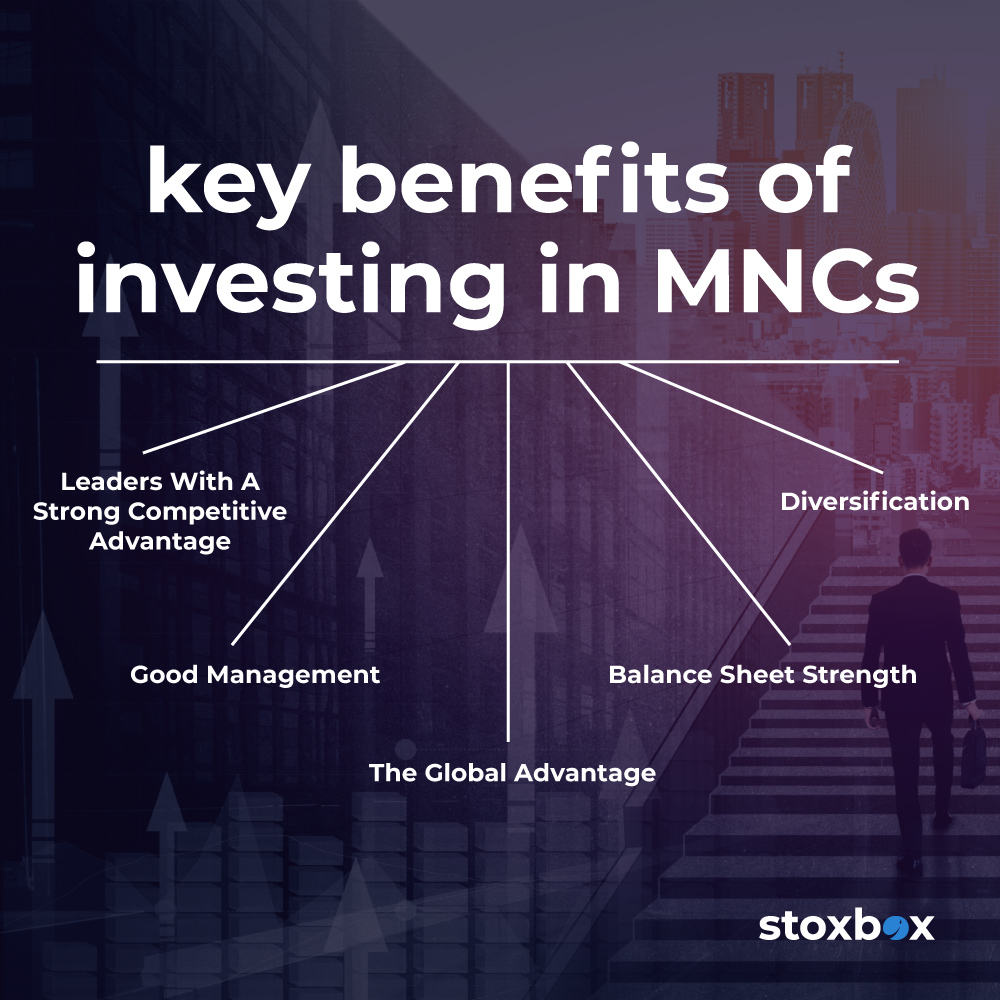

Firms in developing countries need multinational funding and know-how to increase, provide structure, and direct their worldwide sales. These foreign business need personal investments in facilities, power, and water in order to boost jobs and salaries (exempt market dealer). There are different degrees of FDI which vary based on the sort of business included and the reasons for the investments

Amur Capital Management Corporation Things To Know Before You Get This

Various other forms of FDI include the purchase of shares in a linked enterprise, the consolidation of a wholly-owned firm, and participation in an equity joint venture throughout worldwide borders (http://peterjackson.mee.nu/do_you_ever_have_a_dream#c2017). Capitalists who are preparing to involve in any kind of kind of FDI could be important to evaluate the financial investment's advantages and downsides

FDI increases the manufacturing and services industry which leads to the creation of tasks and helps to decrease unemployment prices in the country. Boosted employment translates to higher incomes and outfits the population with more purchasing power, increasing the total economy of a nation. Human capital entailed the understanding and proficiency of a workforce.

The creation of 100% export oriented systems assist to help FDI capitalists in increasing exports from other nations. The circulation of FDI into a nation converts right into a continual circulation of fx, assisting a nation's Reserve bank preserve a prosperous book of forex which results in steady exchange rates.

Getting My Amur Capital Management Corporation To Work

Foreign straight financial investments can sometimes influence exchange prices to the benefit of one nation and the detriment of an additional. When investors invest in foreign regions, they could see that it is a lot more pricey than when items are exported.

Thinking about that foreign straight investments might be capital-intensive from the point of view of the investor, it can often be really high-risk or financially non-viable. Continuous political changes can bring about expropriation. In this instance, those countries' federal governments will certainly have control over capitalists' building and properties. Numerous third-world nations, or a minimum of those with history of colonialism, stress that foreign direct investment would certainly result in some type of modern economic manifest destiny, which subjects host countries and leave them prone to foreign companies' exploitation.

Avoiding the achievement void, enhancing wellness Learn More results, enhancing profits and providing a high price of financial returnthis one-page paper sums up the benefits of buying top quality very early youth education and learning for deprived kids. This document is usually shared with policymakers, supporters and the media to make the case for early childhood education.

The Greatest Guide To Amur Capital Management Corporation

Take into consideration how gold will fit your financial goals and long-term financial investment plan before you spend - investment. Getty Images Gold is frequently thought about a strong asset for and as a in times of uncertainty. The priceless steel can be appealing via durations of economic uncertainty and economic downturn, as well as when rising cost of living runs high

Amur Capital Management Corporation for Dummies

"The optimal time to construct and allocate a model portfolio would certainly be in less unstable and difficult times when emotions aren't controlling decision-making," states Gary Watts, vice president and monetary advisor at Riches Improvement Team. "Sailors clothing and arrangement their watercrafts prior to the tornado."One method to figure out if gold is right for you is by investigating its advantages and disadvantages as a financial investment choice.

So, if you have cash, you're properly shedding cash. Gold, on the other hand, may. Not everybody concurs and gold may not always climb when rising cost of living rises, however it could still be a financial investment factor.: Purchasing gold can possibly help investors get via uncertain economic conditions, thinking about the throughout these durations.

7 Simple Techniques For Amur Capital Management Corporation

That does not imply gold will always rise when the economic situation looks unstable, however maybe good for those who plan ahead.: Some capitalists as a means to. Instead of having every one of your cash locked up in one asset class, different could potentially help you better take care of danger and return.

If these are several of the advantages you're searching for after that begin purchasing gold today. While gold can help add balance and safety for some investors, like a lot of financial investments, there are likewise risks to look out for. Gold might surpass other possessions during particular periods, while not standing up also to long-lasting rate appreciation.

:max_bytes(150000):strip_icc()/financial-advisor-career-information-526017_final-9c1362c7706146ada8c9173002ddee69.png)

:max_bytes(150000):strip_icc()/what-will-a-good-financial-planner-do-for-me-2388442_color2-566eaab6a87b463d951130f508b5aa3e.png)